Mangaluru: The academic excellence of Dakshina Kannada continues to shine as the district secured a commendable 93.57% pass percentage in the II PU examinations, placing it second among all districts in Karnataka. Although it stood first last year with 97.37%, the district has maintained a consistent record of high performance.

Over the past years, Dakshina Kannada's performance has been as follows: 95.33% in 2022-23, 88.02% in 2021-22 (a year in which all students were declared pass due to the COVID-19 pandemic), 90.91% in 2018-19, 91.41% in 2017-18, 89.92% in 2016-17, 90.48% in 2015-16, 93.09% in 2014-15, 86.04% in 2013-14, and 85.88% in 2012-13.

Behind the Performance

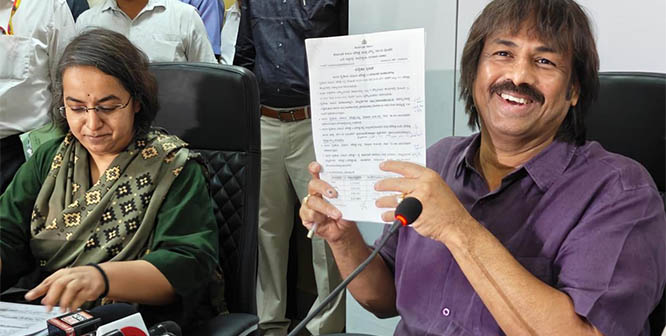

In-charge Deputy Director of the PU Department, Sridhar H G, attributed the results to collective efforts.

“The department constituted taluk-level Shaikshanika Samithis, which analyzed results college-wise and helped identify areas needing improvement. Remedial classes were held for weaker students. Both government and private PU colleges worked hard, aiming for better outcomes. The district has also produced state toppers in both science and commerce streams,” he said.

Science Stream Brilliance from DK

Among the brightest stars is Bindu Navale from Alva’s PU College, who topped the Science stream with 598 marks, sharing the top spot with two others. A dedicated and sincere student, Bindu said she remained calm and consistent throughout the academic year. Her teachers praised her meticulous approach and in-depth understanding of core subjects. She now plans to appear for national-level entrance exams to pursue a career in the medical field.

Commerce Achievers Who Made DK Proud

In the Commerce stream, Pranay Balasaheb Alagouda and Vaishnavi Prasad Bhat, both from Alva’s PU College, secured 597 marks, earning their place among the state toppers. Pranay, who hails from Vijayapura, expressed deep gratitude for the academic environment at his college. He plans to pursue BCom with aspirations of cracking competitive exams. Vaishnavi, known for her consistent performance and disciplined study habits, aspires to explore the field of finance and management in the future.

Top Performers Speak

Shreevidya, a student of Government PU College, Kaniyoor, scored 595 in the Science stream. She said she had expected 598 marks and plans to apply for revaluation.

“I used to study three to four hours daily. Our lecturers supported us with study materials, which really helped. I aspire to clear the UPSC exam and will pursue BSc followed by MSc in Mathematics. I also write poems,” she said.

She is the daughter of Narayana A K and Shailashree.

Shreya S, a student of Expert PU College who hails from Hassan, scored 597 marks in Science. She plans to appear for NEET to pursue a career in medical sciences.

Her parents, Suresh and Savitha, are doctors.

P Yuktha Sree, a student of Vivekananda PU College, secured 593 marks in the Arts stream and expressed her delight at being one of the state toppers.

Hailing from Bengaluru, she said, “I was attentive in class and studied intensively during the final month. I plan to become an IAS officer and will pursue graduation along with UPSC coaching.”

Her principal, Mahesh, noted that Yuktha was diligent and often clarified her doubts with teachers.

Pramukh Tulupule, from Excellent PU College, Moodbidri, scored 596 in Science.

“There was no pressure. I studied regularly, and mock tests conducted by our teachers helped a lot. I aim to become an engineer,” he shared.

Anoop Shawn Gomes, also from Excellent PU College, Moodbidri, secured 596 marks in the Commerce stream.

Originally from Balehonnur in Chikkamagaluru, he said, “The environment in the college and hostel was supportive. I plan to pursue BCom along with Chartered Accountancy.”

Other Toppers

Arts Stream:

Prakruthi N, Alva’s PU College – 591

G Lavanya, St Aloysius PU College – 590

Niriksha Ria Noronha, St Agnes College – 590

Thafhima Fathima, St Aloysius PU College – 590

Banavath Mayukha, Alva’s PU College – 589

Commerce Stream:

Pranay Balasaheb Alagouda, Alva’s PU College – 597

Vaishnavi Prasad Bhat, Alva’s PU College – 597

Anoop Shawn Gomes, Excellent PU College, Moodbidri – 596

Hanshitha Shetty, St Aloysius PU College – 595

N Bindu Bhat, Canara PU College – 595

Priyamvrath Bhat, Vijaya PU College, Mulki – 595

Richa Ganesh Dalvi, Shakthi PU College – 595

Sannidhi Mangesh Shanbagh, Alva’s PU College – 595

Sharel Lavita Rodrigues, Alva’s PU College – 595

Vismaya Bhat, Alva’s PU College – 595

Adithi K, Excellent PU College – 594

Chaitanya N, Vivekananda PU College – 594

K S Siri Gowri, Vikas PU College – 594

Minnal Binu, Govinda Dasa PU College – 594

Pradyumna R Urala, St Aloysius PU College – 594

Shreyas M, Mangalore Independent PU College – 594

Vaishnavi Shetty, Alva’s PU College – 594

Science Stream:

Bindu Navale, Alva’s PU College – 598

Raja Yadu Vamshi Yadav, Alva’s PU College – 598

Vijet G Gowda, Alva’s PU College – 598

Akshay M Hegde, Alva’s PU College – 597

Preksha M S, Alva’s PU College – 597

Padmavati Malleshappa Badagi, Alva’s PU College – 596

Shadjay A P, Expert PU College – 596

Abhiraam Bhat, Satya Sai Lokaseva PU College – 595

Chinmanyi R, Expert PU College – 595

Darshan Shetty, Alva’s PU College – 595

Dhanyatha Gowda, Expert PU College – 595

Shri Vatsa, Satya Sai Loka Seva College – 595

Tushara B S, SDM College – 595

Rohan H Shenoy, Expert PU College – 595

Vachana Bagodi, Expert PU College – 595

Comments

Add new comment